In financial reporting and compliance, statutory audit services are crucial for businesses in Singapore. This guide will help you understand statutory audits better, discussing their importance, legal requirements under the Singapore Companies Act, and how to select the right audit firm for your needs.

Key Highlights

Statutory audits ensure transparency in financial reporting and adherence to regulations in Singapore.

ACRA Statistics: Approximately 80% of companies in Singapore are required to undergo statutory audits annually, highlighting their importance in maintaining corporate governance.

Key Factors in Selecting an Audit Firm

- Look for experts with industry knowledge.

- Ensure they have a solid understanding of local laws.

- Verify their track record of providing reliable audit and assurance services.

Preparation Tips for Businesses

- Understand the statutory audit process.

- Be aware of potential challenges to ensure a smooth audit experience.

Benefits of Working with an Experienced Audit Firm

- Identifies risks effectively.

- Improves internal controls.

- Enhances the trustworthiness of financial reporting.

- Example: Companies engaging in regular audits report 30% fewer financial misstatements compared to those without regular audits.

Understanding Statutory Audit Services in Singapore

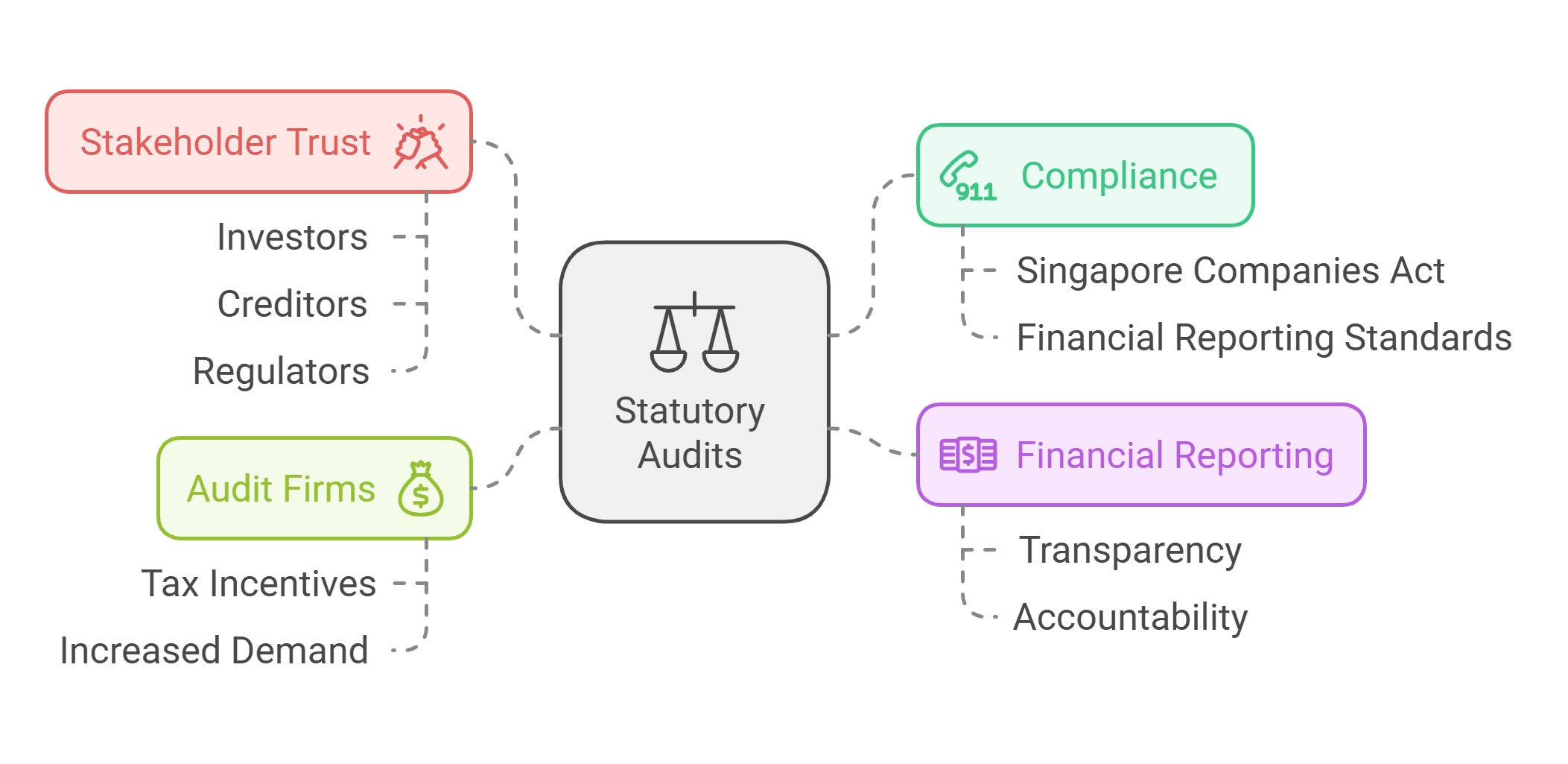

This audit ensures that businesses follow the strict rules in the Singapore Companies Act and current financial reporting standards. Independent and qualified audit firms carry out these statutory audits, which can also help organizations qualify for tax incentives.

In Singapore, these audits are key for keeping financial reporting clear, trustworthy, and responsible. By thoroughly examining financial information, statutory audits help build trust among stakeholders, such as investors, creditors, and regulators.

The demand for audit services has increased significantly; according to a report by ACCA, 57% of respondents in Singapore allocated budgets exceeding US$100,000 for professional accountancy services over multiple financial years (ACCA).

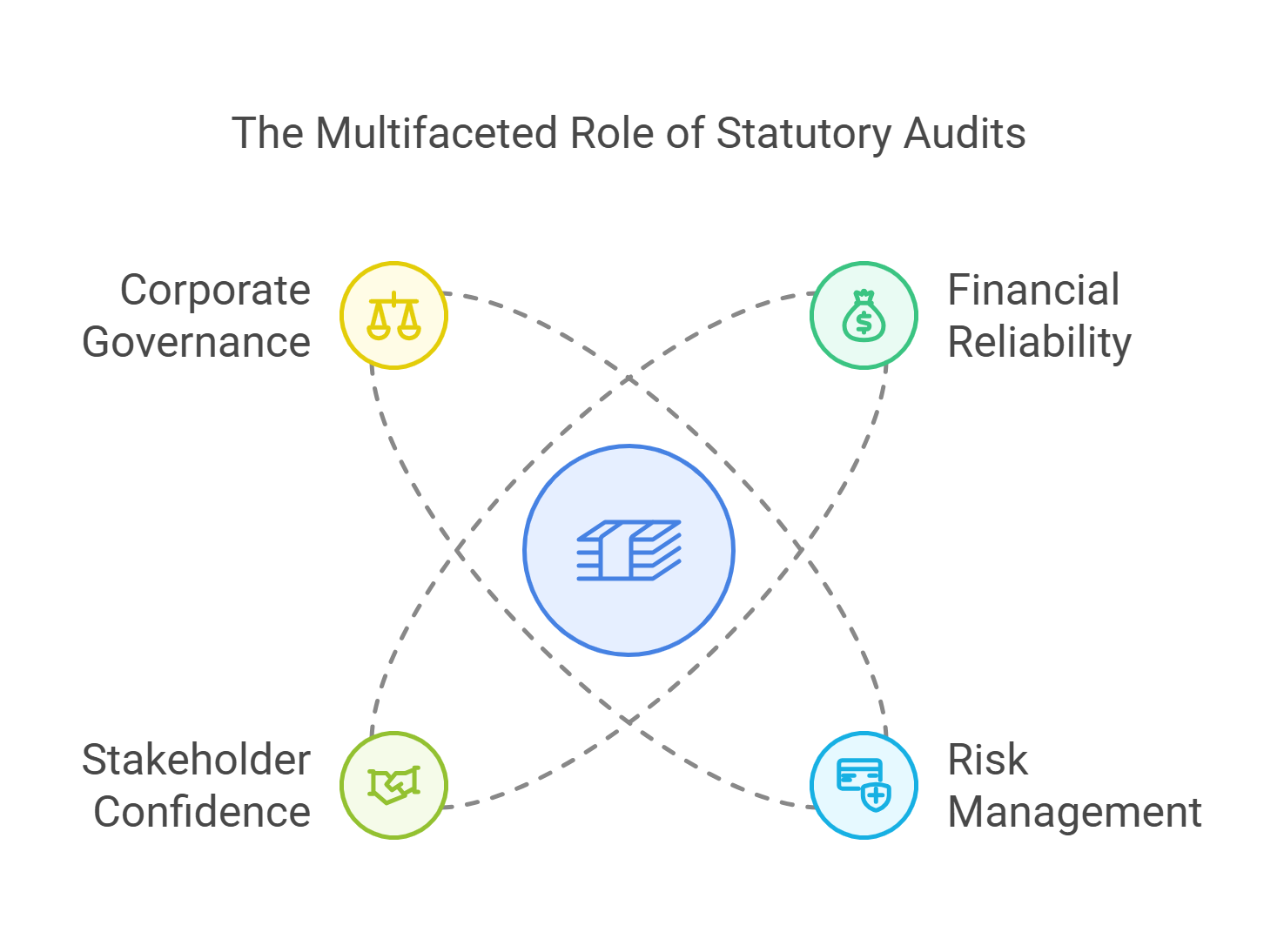

The Importance of Company Statutory Audit Services

Statutory audits play a significant role in ensuring that financial statements are reliable and promote good corporate governance. They provide an unbiased assessment of a company’s financial health, ensuring that its reporting is accurate and trustworthy.

These audits support risk management by identifying potential financial issues, weaknesses in internal controls, and areas where compliance may be lacking. A study by ACRA indicated that companies with robust internal controls reported 15% higher profitability than those without such measures (ACRA). Early detection of problems allows businesses to take corrective actions, thereby reducing financial risks and enhancing their overall health.

Moreover, statutory audits instill confidence among stakeholders, particularly in public companies. They demonstrate that the company’s financial statements accurately reflect its financial condition, which bolsters its reputation and credibility within the business community.

Key Legal Requirements for Local Statutory Audits in Singapore

The Companies Act of Singapore outlines specific requirements for statutory audits. It mandates that all companies appoint a qualified auditor registered with ACRA within three months of incorporation (Precursor Assurance). Failure to comply may result in penalties up to S$5,000 or more severe consequences depending on the nature of the violation.

The appointed auditor must adhere to Singapore Auditing Standards to ensure that audits are conducted diligently, fairly, and honestly. After completing an audit, the auditor must issue a report stating whether the company’s accounting records and financial statements are fair and accurate. This report is crucial for maintaining stakeholder confidence and ensuring accountability.

Criteria for Choosing a Statutory Audit Service Firm

Selecting the right statutory audit firm is essential for any business. A competent audit firm can assist with compliance while providing valuable insights to enhance financial health. When evaluating potential firms, consider:

- Expertise in Your Industry: Look for firms with experience relevant to your specific sector or industry.

- Understanding Regulatory Requirements: Ensure they have a thorough grasp of local laws and regulations affecting your business.

- Track Record: Review their history of success in conducting similar audits.

- Size of the Firm: Larger firms may offer more resources but smaller firms might provide more personalized service.

Team of Statutory Auditors’ Expertise and Credentials

When choosing an audit firm for a statutory audit, focus on the qualifications of its team members. It is vital to find a firm with certified professionals recognized as approved company auditors by ACRA. The audit team should be well-versed in auditing standards and accounting principles while staying updated on changes in financial reporting.

A strong track record in similar audits indicates capability and commitment to quality. Additionally, consider whether you prefer the resources of a larger firm or the personalized attention from a smaller one.

Experience with Industry-Specific Auditing Standards

Different industries have unique accounting rules, financial reporting standards, and regulations. Hiring an audit firm experienced in your industry ensures they understand your business’s specific risks and challenges. This knowledge allows them to develop an effective audit plan tailored to your needs.

Moreover, firms with strong industry connections can provide valuable insights and access to expertise that enhances the overall audit process (Bestar Services).

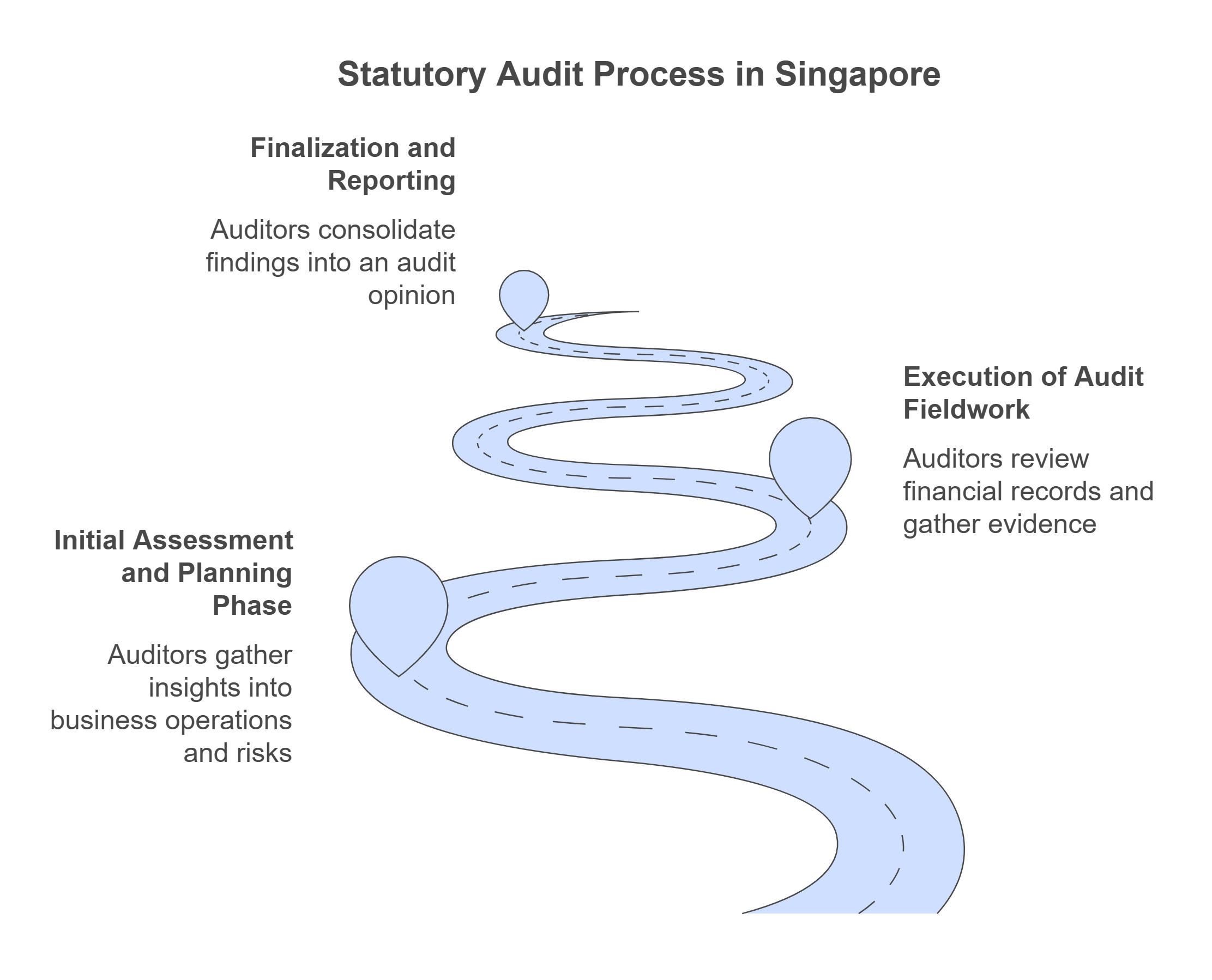

The Statutory Audit Process Explained

Understanding the statutory audit process is crucial for businesses seeking a seamless experience. In Singapore, this process typically unfolds in three main stages:

Initial Assessment and Planning Phase

The initial phase is critical as it sets the foundation for the entire audit process. The audit firm begins by gaining insights into business operations, industry dynamics, and associated risks.

This involves close collaboration with company management to gather essential information such as financial statements, accounting policies, and internal control documentation.

Through discussions and analysis of past financial data—where over 70% of discrepancies are often found—auditors assess risks which inform their customized audit procedures (Precursor Assurance). Following this risk assessment, they develop a detailed audit plan outlining how the audit will be conducted.

Execution of Audit Fieldwork

During this phase, auditors gather sufficient evidence through various steps including reviewing financial records like invoices and bank statements to verify transaction accuracy. They also conduct analytical procedures to identify unusual trends or discrepancies within financial data.

Regular communication between auditors and management during fieldwork ensures transparency about progress and any significant findings or issues encountered.

Finalization and Reporting

The finalization phase consolidates findings from the audit fieldwork into an opinion regarding the fairness of the company’s financial statements.

Auditors communicate their conclusions through a management letter detailing identified weaknesses in internal controls along with recommendations for improvement.

The culmination of this process results in an independent audit report which states whether the company’s financial statements comply with applicable accounting standards (Bestar Services). This report is presented alongside annual financial statements at the annual general meeting (AGM).

Audit Opinion Descriptions

- Unqualified Opinion: Indicates that financial statements present fairly according to applicable frameworks.

- Qualified Opinion: States that while most aspects are fair, there are specific exceptions.

- Adverse Opinion: Concludes that the statements do not fairly represent the company’s position due to significant misstatements.

- Disclaimer of Opinion: Occurs when auditors cannot form an opinion due to insufficient evidence or limitations imposed during auditing (Audit Committee Guide).

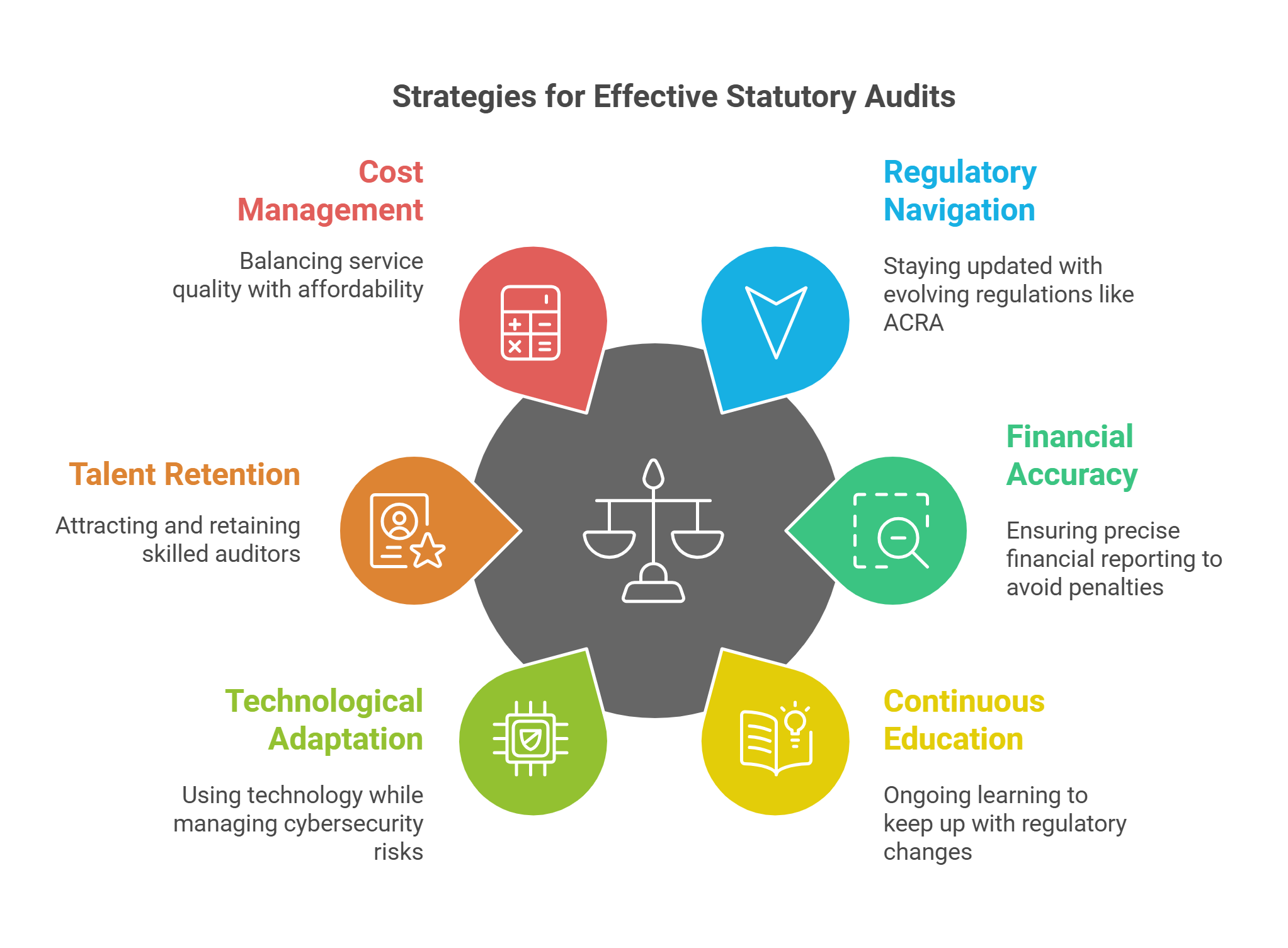

Common Challenges in Statutory Audit Services

While statutory auditing is crucial for compliance, it presents several challenges:

- Navigating Complex Regulatory Requirements: Staying updated on evolving regulations like those from ACRA can be demanding.

- Ensuring Accuracy in Financial Reporting: Mistakes or omissions can lead to inaccurate statements which may incur penalties (Singapore Legal Advice).

To mitigate these challenges effectively:

- Continuous Education: Auditors must continuously educate themselves on regulatory changes while implementing robust internal controls within client organizations.

- Technological Adaptation: Embracing technology can streamline processes; however, statutory auditors must stay informed about cybersecurity risks associated with digital operations.

- Talent Retention: Attracting skilled statutory auditors who understand complex regulations is essential as many firms face talent shortages (Audit Regulation in Singapore).

- Cost Management: Balancing affordability while maintaining quality services becomes increasingly challenging amid rising operational costs (Bestar Services).

Conclusion

Choosing the right accounting firm for statutory audit services is vital for maintaining compliance and ensuring sound financial health. Given Singapore’s complex regulatory landscape—where over 30% of companies face penalties due to non-compliance—partnering with experts who possess industry-specific experience is essential for accurate reporting (Precursor Assurance).

A proficient audit partner can streamline your statutory audit process while safeguarding your business’s integrity and reputation among stakeholders. If you have questions or require assistance regarding statutory audits, our expert team is here to help guide you through this critical process.

——-

Frequently Asked Questions

1. What Determines the Need for Audit Services in Singapore?

In Singapore, the Companies Act specifies criteria determining whether a company requires a statutory audit based on factors like total annual revenue or number of employees (Singapore Legal Advice). Small companies may be exempt if they meet specific conditions over two consecutive years; specifically:

- Total annual revenue under S$10 million

- Total assets not exceeding S$10 million

- Fewer than 50 employees

2. What Role Does a Statutory Audit Play?

Statutory audits provide independent verification of financial statements ensuring they accurately reflect a company’s position while fostering good corporate governance practices.

3. Are Audit Services Mandatory in Singapore?

Yes, most companies must undergo annual statutory audits unless they qualify as small companies or meet other exemption criteria outlined by ACRA.

4. What Is the Difference Between External Audits and Statutory Audits?

While both types involve independent assessments of financial records, statutory audits are mandated by law under specific regulations while external audits may be voluntary or serve different purposes such as operational efficiency evaluations.

—–

References

- Accounting and Corporate Regulatory Authority (ACRA)

- Bestar Services – “Know Benefits of Statutory Audit Services for Singaporean Firms”

- Precursor Assurance – “Key Facts About a Statutory Audit in Singapore”

- Auditor-General’s Office (AGO) – “Auditor-General Report 2023/24”

- Singapore Exchange (SGX)

- Gutzy Asia – “Auditor-General’s Report Uncovers Significant Lapses in Singapore Ministries and Statutory Boards”

- Paul Hype Page & Co – “What Laws Govern The Statutory Audits Of Companies In Singapore?”

- LinkedIn Article by Roger Pay – “Facts About Statutory Audit of Companies in Singapore”

- DataSnipper – “Exploring Audit Challenges Facing Firms Today”